|

||||

|

December

2018 |

||||

|

||||

| Forward | Subscribe |

||||

| Refer a Case | | | Ringler Home | | | Find Advisor | | | Everybody Wins |

Everyone Faces the Post-Settlement

Risk Factor

Most of our readers know that when settling a workers’ compensation claim involving past, current or future medical expenses, Medicare’s interest must be considered as part of the settlement process. Failure to do so (and prove it) can jeopardize current or future Medicare benefits for the injured party, or expose the plaintiff attorney and even the insurance company/defendant to stiff fines or penalties. And while the agency that manages Medicare benefits – the Center for Medicare and Medicaid Services (CMS) – does not currently review third-party liability settlements involving future medicals, the winds are blowing strongly in that direction, as we have discussed here in the past.

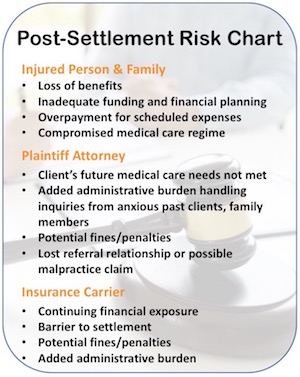

But we’re talking about a government agency, so making good on Medicare’s “consideration” requirement, with all the reporting red tape involved, can be very difficult and stressful for anyone, especially injured people and their families. And that puts EVERYONE at post-settlement risk (see chart above).

Pass on the Settlement Baton with Confidence

The peace-of-mind solution to all of this uncertainty is a team of settlement/post-settlement professionals who combine a Medicare Set-Aside (MSA), a structured settlement and management services for Medicare-Medicaid reimbursement.

Orlando attorney Paolo Longo Jr., featured on Ringler Radio (episode here).

Orlando attorney Paolo Longo Jr., featured on Ringler Radio (episode here).The result, according to Paolo Longo Jr., a partner with the Orlando law firm of Bichler, Oliver, Longo & Fox, and a recent guest on Ringler Radio: “I can hand off the proverbial baton with confidence because I know the future medical care of my client will be taken care of.”

Here’s how it works:

-

An MSA is created during settlement negotiations for the injured party by a settlement advisor experienced in the complexities of Medicare compliance and documentation (that’d be us) in conjunction with a medical expense management company (we work with several).

-

A structure is designed that will fund the MSA based on extensive life care planning for the injured person and the benefits available through Medicare. The tax-free payments thrown off by a qualified structure can save the client money in the long run and help facilitate settlement negotiations.

-

Once the settlement agreement is inked, the management company issues a payment card that the injured person presents at doctor appointments, therapy sessions, pharmacies, etc.

-

All bills go directly to the management company for review, validation under MSA requirements, and payment. Any available discounts are applied, saving additional funds for future care.

- All accounting and reporting to CMS is done automatically. Thus, the injured person never touches a medical bill or wrestles with mountains of reimbursement paperwork.

“They Don’t Teach this Stuff in Law School”

“When it comes to annuities and MSAs, it’s nice to have experts who know the language and can walk my clients through what’s going to happen post-settlement,” continued Longo, “like where they will get medical coverage or which doctors they can see. It makes my job easier, because it makes my clients feel secure.” If clients don’t know what’s going to happen to them after the case settles, they’re not going to settle the case, pointed out Longo.

“They don’t teach this stuff in law school,” he added.

Longo went on to say that he automatically builds MSA management services into the settlement agreement and has the insurance carrier cover the costs. “I think it's almost malpractice for me to allow my clients to administer their own funds,” he said, “so I pretty much require it. I tell them it’s totally stress and worry free.” Longo’s law firm often represents first responders with serious work injuries (see this month’s Structure Strategies).

And speaking of costs, fees for MSA management ranged from $20,000 to $30,000 in years past but have come down dramatically and are now available for as little as $1,000 from companies like Ametros, the largest medical administration firm in the country and a preferred partner at Ringler.

We’ve Only Just Begun

The Carpenters

The CarpentersYou may recognize We’ve Only Just Begun as the hit song recorded by brother-sister duo The Carpenters, but did you know it was originally written for a bank television commercial?

If you’ve just begun your journey to better understand the interests of Medicare in the settlement process, MSAs powered by structured settlements and medical administration services, you should begin with a call to your trusted Ringler advisor. We’re standing by now with everybody wins solutions just for you.