|

||||

|

March

2017 |

||||

|

||||

| Forward | Subscribe |

||||

| Refer a Case | | | Ringler Home | | | Find Advisor | | | Everybody Wins |

Bad Bears Meet the Fear & Greed Index: Perspectives on the Modern Market Part II

“The only thing we know for sure about what the stock market will do is that we DON’T know what it will do.” Fliers describing registered securities carry disclaimers that past performance does not guarantee future results, but as we discussed in Part I of this series in the last issue of IN YOUR INTEREST, we can draw some conclusions by studying history.

Over the last 100 years, there have been four major BEAR MARKETS. While this may not sound too terrifying, the frequency is not unlike the seismic studies geologists perform along major fault lines. They can’t predict when an earthquake will occur, but increasing activity is cause for alarm. In the same way, accident victims should be mindful of the fact that TWO of these four major bear markets have occurred during their lifetimes.

The Four Bears on the Prowl

In each of the four major bear markets, stock values plummeted by more than 50 percent on an inflation-adjusted basis and took years to return to previous highs. Here is a summary of each:

- Crash of 1929 (-82.4 percent): This market catastrophe ushered in the Great Depression and set the stage for John Steinbeck’s The Grapes of Wrath.

- Oil Embargo of 1973 (-50.1 percent): Shortages led to long lines at the gas pump and a historic spike in interest rates.

- Tech Bubble of 2000 (-52 percent): Tech stocks were trading for values far in excess of what company earnings justified. This “adjustment” was far more painful to many than the sort received at a chiropractor’s office.

- Financial Crisis of 2008 (-57.5 percent): Reality wasn’t what it seemed as subprime mortgages started an avalanche of tumbling investor confidence in corporate America. Individuals receiving large settlements would do well to watch The Big Short.

Data Manipulation Paints Over An Ugly Picture

|

| Vulnerable investors may lose their “catch” to hungry bears. |

The financial industry has mastered the art of choosing which data paints the most serene and optimistic landscape for prospective investors. The crux here is one of both timing and investment suitability. Many accident victims and/or their survivors have lost the ability to produce income. A settlement may be, in effect, the last paycheck of their lifetimes. Investment counsel for these individuals should follow the same conservative approach recommended for retirees, and with the same emphasis: capital preservation.

Timing is a real issue then when one considers the potential effect of a bear (or even “cub”) market. Income drawn off a portfolio during market downturns will never experience a recovery. Hypothetical investment illustrations often project AVERAGE returns taken from chosen time periods. The problem with this approach is that the market doesn’t serve up average returns, but rather bumps, grinds, and climbs and falls like a roller coaster. So, forget those serene landscapes: Scrape the paint off and one may find themselves in the middle of Botticelli’s rendition of Dante’s Inferno (that’s HELL for you non-art historians).

The Last Thing Accident Victims Need Is More Worry

DALBAR is a leading market research company with a long history of measuring actual investor performance. In a nutshell, its data shows that investors generally UNDERPERFORM the market by 3 to 4 percent. This is understandable when you put yourself in the roller coaster and start heading downhill, in the DARK. Not knowing where the bottom is causes people to panic and withdraw funds. They don’t know if they’re experiencing an “adjustment,” a “cub,” or a full-blown “bear” market.

Exposing accident victims to too much unnecessary worry or concern over investment performance should be avoided, particularly when they can guarantee what they don’t want to leave to chance.

Structured Settlements to the Rescue

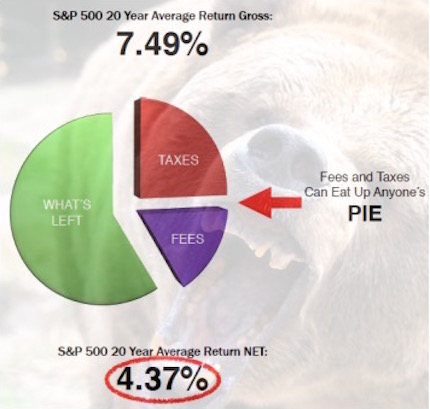

Suitability expectations require that investment professionals incorporate a healthy percentage of fixed-income securities within portfolios managed for minors, catastrophically injured individuals and certain survivors of a wrongful death. That means bonds. Structured settlements are funded by structured annuities, backed by the general portfolios of major insurance companies. That also means bonds. The key difference is that the returns generated by the annuities are tax-free and not subject to ongoing investment management expenses.

This simple difference, along with a guarantee of lifetime income that comes with a life annuity, can deliver the quality of life that accident victims seek. Market-based investments have their place, in particular to offset the long-term effects of inflation. However, these financial products should be used in moderation AFTER establishing the necessary guaranteed income afforded by a structured settlement.

If history repeats itself and our story changes to "The FIVE Bears," the people who chose these guarantees will still be able to sleep at night and live well. Contact your RINGLER representative for help writing your client a story with a happy ending.