|

||||

|

Sept

2019 |

||||

|

||||

| Forward | Subscribe |

||||

| Refer a Case | | | Michael Zea Profile | | | Jarrod Zea Profile | | | Structures and Workers' Comp |

Bridge the Gap with a Special Needs Trust:

Identify, Protect Clients on Means-Tested Benefits

CPT Institute is a non-profit dedicated to helping settlement professionals utilize Special Needs Trusts. For more information, visit CPTInstitute.org or email Cameron Lindahl at cameron@cpttrust.org.

CPT Institute is a non-profit dedicated to helping settlement professionals utilize Special Needs Trusts. For more information, visit CPTInstitute.org or email Cameron Lindahl at cameron@cpttrust.org.

By Cameron Lindahl, M.S., Guest Author, CPT Institute

The purpose of this article is to empower attorneys and claims professionals to identify and protect injured people who are utilizing means-tested benefits. Means-tested benefits should always be considered when accepting a settlement, and the flexibility provided within a Special Needs Trust (SNT) has never been greater for those who have suffered a disabling injury.

We will discuss recent policy updates that increase flexibility for clients of Special Needs Trusts while briefly summarizing the value of common means-tested programs – Medicaid and Supplemental Security Income (SSI). The concluding section will provide guidelines on how to more effectively identify qualifying clients.

Recent Policy Changes Make SNTs More Attractive

The most common means-tested government benefits that arise during the settlement process are Medicaid (name can vary by state) and Supplemental Security Income (SSI), both of which can be protected by a Special Needs Trust or a Spend Down.

A Special Needs Trust is used to preserve eligibility for state Medicaid and/or SSI. It is overseen by a trustee’s fiduciary duty and is usually written to be state compliant with eligibility standards in each state. The trustees are there to make sure the money is spent in the best interest of clients (often relative to their appropriate level of care) while protecting their eligibility to the health care (Medicaid) and/or income (SSI) that they depend on.

Recent policy changes have made establishing an SNT more attractive than ever due to increased flexibility for both trustees and their clients. The best example of this is the approval of True Link Secured Visa Cards, which provide clients with immediate access to their trust funds. Secondly, “sole benefit” was replaced with “primary benefit,” helping trustees make disbursements for products that other members of the family may also occasionally use such as a living-room television. These two policy changes just scratch the surface, but if you would like to learn more about the changes relevant to the settlement process, please see our blog How the 2018 POMS Update Affects Trust Beneficiaries.

Know What’s at Stake

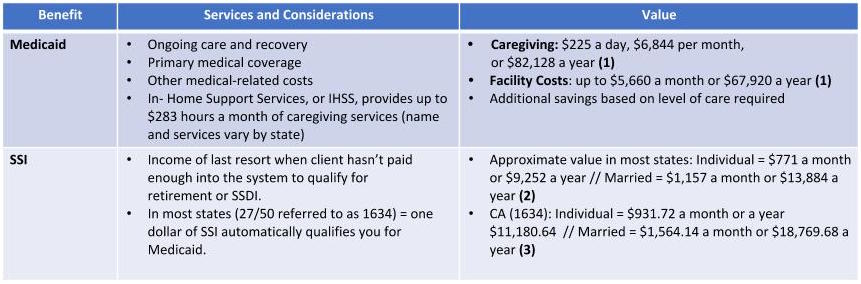

Before making a post-settlement decision, it's important that the attorney and client understand what benefits are being forfeited by accepting a settlement without an SNT. The chart below provides a quick snapshot (download chart here):

(1) Average cost of caregiving and skilled nursing facilties in the U.S. (2) Maximum Federal Benefit Rate for SSI, 2019 (3) California State Supplemental for SSI

The value to the injured person can be significant, especially when planning for extensive care needs or a long life expectancy. There are a variety of settlement strategies to better maximize an award such as paying caregivers within the family, utilizing an ABLE, and purchasing a home outside the trust to prevent Medicaid’s recovery at time of death (see partial Spend Down). Before considering these strategies, however, it’s important that professionals learn to quickly identify these clients.

Protect the Client, Protect Yourself

“What are the household forms of income, and is a spouse or child disabled?”

Nine out of 10 times, this is all a trust officer needs to know in deciding whether or not a trust should be considered. Attorneys should include this question on their intake forms and use the following guidelines to quickly identify cases where eligibility could be jeopardized:

- Receives SSI: typically less than $772 per month, or $932 in CA (Increases are made for severe disabilities and in areas with a high cost of living.)

-

Receives Medicaid and one of the following forms of income:

- SSI

- Social Security Disability Insurance (SSDI): Typically more than $771 per month

- Social Security Retirement: Typically more than $771 per month - A spouse or child in the household is disabled (see Parental and Spousal Deeming, or contact a qualified professional)

- Potential need for a long-term care facility or caregiving services in the future

- Has a disabled child (minor or adult) they wish to gift the funds to

Note that most clients don’t understand the differences between the forms of income from the Social Security Administration and how a settlement can impact them. Simply have the client visit ssa.gov/myaccount or their local SSA office to obtain a Benefits Verification Letter.

Just a Starting Point

The guidelines above are not all inclusive, but rather a starting point for legal professionals to better protect clients with disabilities while maximizing their award. In a future issue of IN YOUR INTEREST, we will address some common settlement strategies to bridge the gap at the settlement table. In the meantime, know that your Ringler settlement planner is trained to coordinate experts in estate planning, tax issues and trusts. Together, we can create extensive planning opportunities to help the injured and create a more secure future for them and their families.